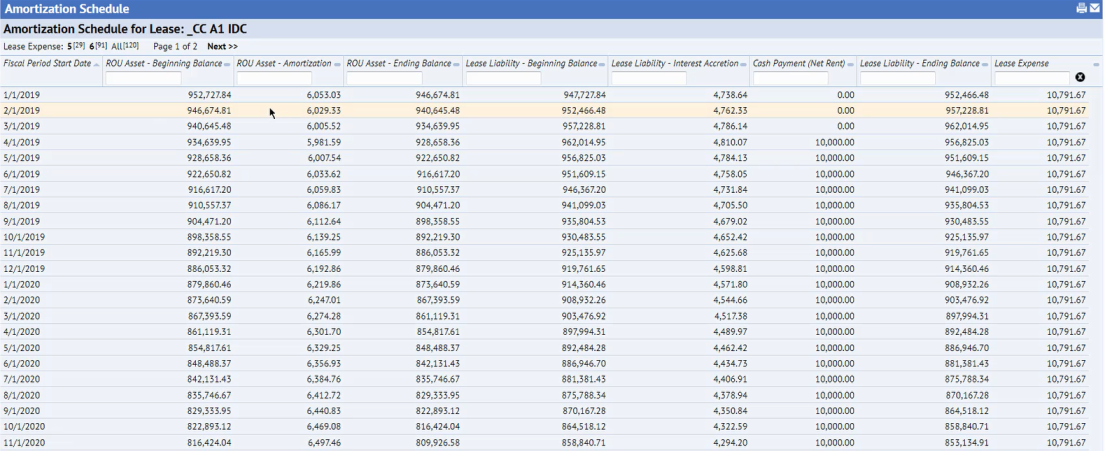

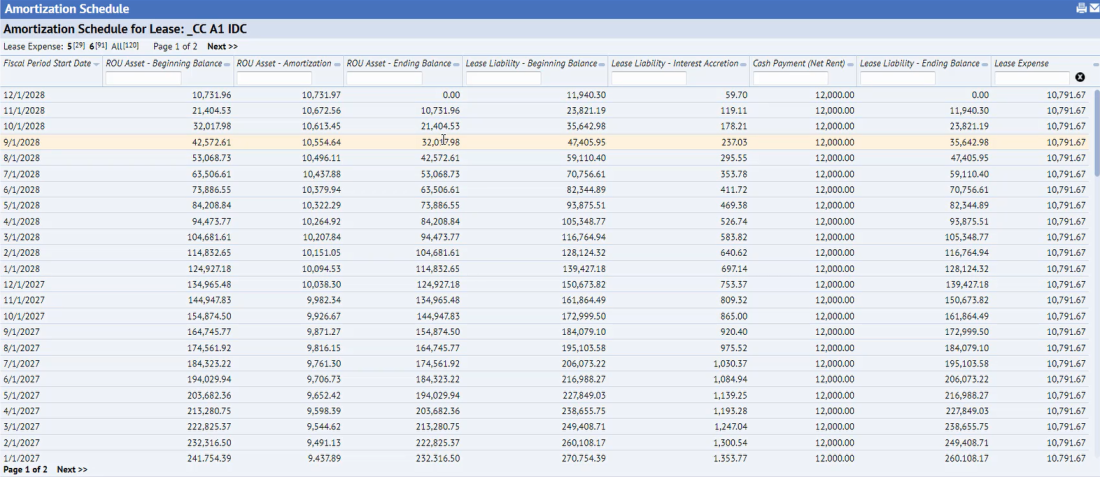

The amortization schedule tracks the changes in ROU Asset and Lease Liability for the various time periods of the lease.

When you complete the various tabs of the Lease Classification Wizard, the Wizard calculates the amortization schedule and stores it in the Lease Amortization Schedule table (ls_amort_sched).

The amortization schedule routine calculates and stores several values including: ROU Asset Amortization value, ROU Asset - Ending Balance, Cash Payments, Lease Liability Ending Balance.

For legacy leases the Wizard creates both:

When working with the Lease Classification Wizard, you can access the amortization schedule for the current lease by selecting the Amortization button. Before approving a lease classification, a Lease Manager can review the schedule to understand how a lease classification was derived.

In a pop-up window, the Wizard presents the last calculated amortization schedule for the current lease; the lease will have a FASB/IASB Review Status of either Pending or Approved. You can check the ROU Asset, Lease Liability, and Ending Balance values.

If you examine the final fiscal periods of the lease, you can see that the Ending Balance for ROU Asset and Lease Liability reduce to zero.

You may want to review the amortization schedule in these circumstances:

The stakeholder reports, such as Lease Expense Recognition, summarize the amortization data from the Lease Amortization Schedule table. If you have questions on the report, you can check the amortization schedule on which the report's data is based.

To further analyze the lease amortization, you can use Smart Client to load the Lease Amortization Schedule table (ls_amort_sched) and run the Smart Client's View/Analysis command.

There are two ways to calculate the amortization schedule:

For details on the calculations, see Calculating the Amortization Schedule.

| Copyright © 1984-2019, ARCHIBUS, Inc. All rights reserved. |