Lease administration often must supply the schedule of charges to accounting that represent:

Typically, lease administration provides this information yearly or quarterly after all lease costs and FASB conditions have been reviewed and all lease classifications have an "Approved" status. Accounting uses this information to inform the quarterly and annual reporting.

Use the Real Estate Portfolio Management / Lease Administration / Lease Portfolio / Generate Ledger Entries for Leases task to generate this information for your company's general ledger. The system generate subledger entries based on the lease information and the latest amortization schedule and stores the entries in the Lease Subledger Entries (ls_ledger_entries) table. If the ROU Asset has been previously reported and then adjusted through the formal re-evaluation process, the system generates gain or loss ledger items reflecting the restatement.

The previously-defined Real Estate Portfolio Management / Lease Administration / Background Data specify the account codes and how the routine works with legacy leases.

Prerequisite: Real Estate Portfolio Management / Lease Administration / Background Data

Subledger - Single Entries. To generate "one-sided" sub-ledger entries to be mapped to different accounts by the accounting software on import.

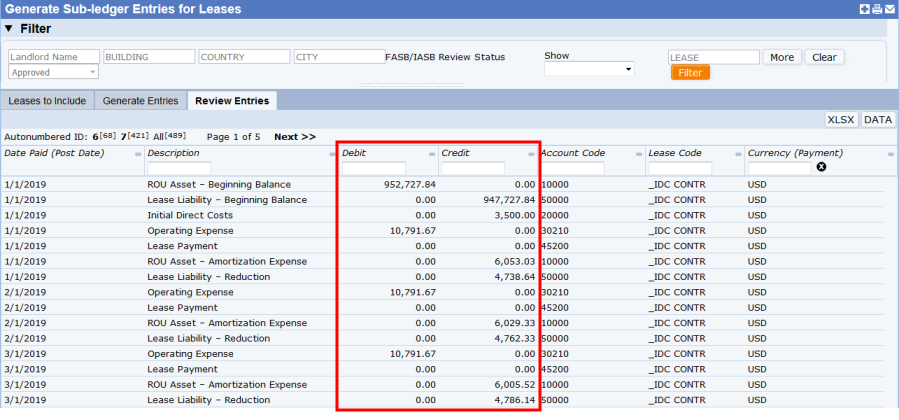

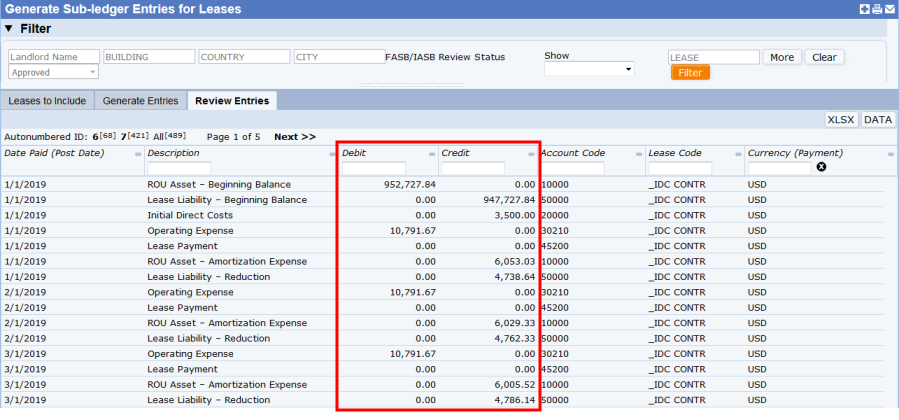

Subledger - Double Entries. To generate "two-sided" subledger entries mapped to counter-balancing accounts. In the above image, the system has generated double entries. That is, if an item is a Debit, the system completes the Credit field with zero; if Credit has a value, the system completes Debit with zero.

Once you export the data to Excel, the accounting system can reconcile the difference between what is on the books in the ROU Asset and the lease liability:

For operating leases, the exported values enable the accounting system reconcile the difference between the Net Rent (i.e. actual Cash Payment paid month to month and year to year) and the Operating Expense declared (i.e. the straight-line rent).

For finance leases, the exported values enable the accounting system reconcile the different between the Net Rent (Cash Payment) and the amortized components of the lease expense:

Subledger Report on the Lease Classification Wizard

| Copyright © 1984-2019, ARCHIBUS, Inc. All rights reserved. |