From the Real Estate Portfolio Management / Lease Administration / Lease Portfolio / Lease Expense Recognition task, stakeholders reviewing FASB information can generate several reports and aggregations of the amortization schedule. These reports summarize amortization schedule data stored in the ls_amort_sched table.

Note the following about these reports:

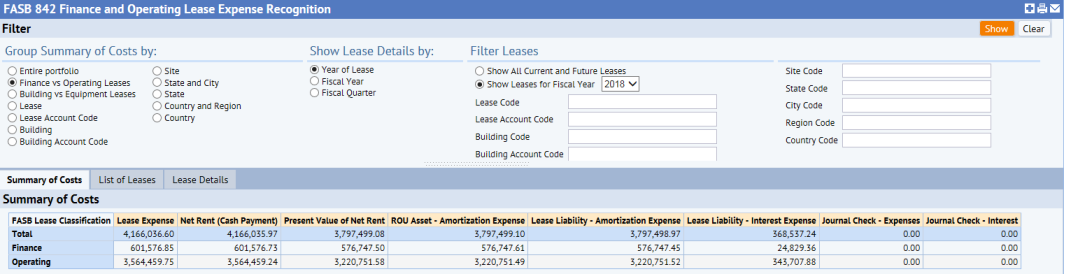

As shown above, you can group costs and filter by several fields.

"Group Summary of Costs by" option determines the rows in the Summary of Costs tab. For example, the above image shows grouping costs by Operating Lease vs Finance Lease. The options you set for this control affect only the Summary of Costs tab.

In the Filter Leases section, set the criteria to determine what leases to use in the report. The options in the Filter Leases section affect the data displayed in all tabs.

You must specify whether you want to report on all leases, or leases only for a specific fiscal year. The Show Leases for Fiscal Year option sets the Start and End Date of the analysis to the Start Date and End Date of the given Fiscal Year.

Once you click Show in the filter pane, the Summary of Costs tab presents key calculations about your leases according to the criteria that you specified for Group Summary by Costs.

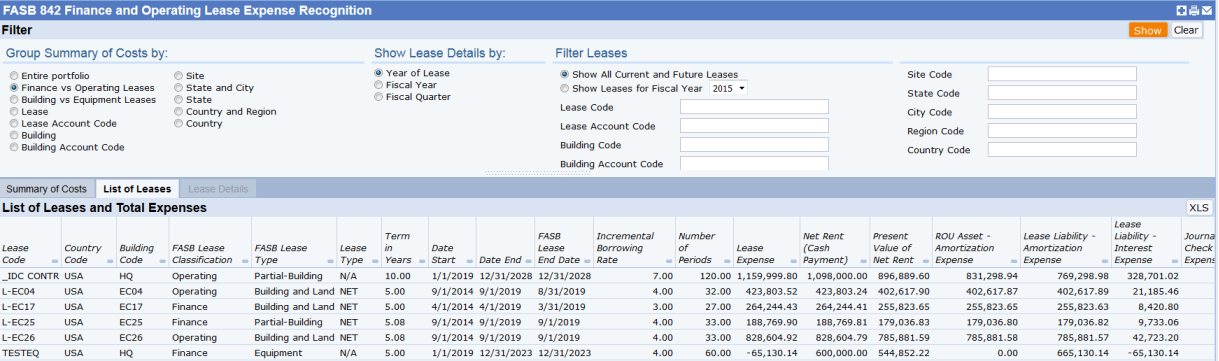

If you want to check the specific leases that contributed to this summary data, click the List of Leases tab and you can check the statistics for each lease.

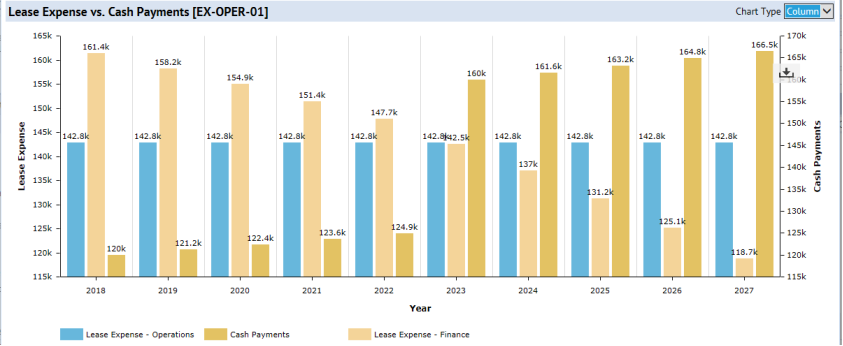

Use the Expense Comparison Chart to compare the effects of lease classification on expense recognition.

| Copyright © 1984-2019, ARCHIBUS, Inc. All rights reserved. |