Open topic with navigation

Real Estate Portfolio Management / Strategic Financial Analysis / Financial Analysis

Forecast Income and Expenses

Use this action to estimate operating expenses for a selected building or property. Typically, you would run the Forecast Income and Expenses action when you add a building or property and want to budget lifecycle expenses.

The action creates recurring income and expense cost records for the asset (building or property). Once the records are created, you can review and change them in the Cost Wizard.

Note: Usually, capital projects and equipment only generate mission value or income by being part of a larger facility. For this reason, income and expenses are not forecasted for project and equipment. However, you can opt to include the values for project and equipment costs in your metrics for properties and buildings when you run the Forecast Capital Costs action. See Forecast Capital Costs and Project and Equipment Costs.

After you run the action to forecast income and expenses, when you view the building or property from the Buildings and Forecasts or Properties and Forecasts tabs (Aggregate and Forecast Costs task), the Has Estimate? field is set to Yes to indicate that the action has been run.

Procedure: Forecast Income and Expenses

To forecast income and expenses for a property or building:

- Select one of the following tasks:

Strategic Financial Analysis / Financial Analysis / Aggregate and Forecast Costs for

The Aggregate and Forecast Costs form displays the Building Forecast or Property Forecast tab, depending on your selection.

- Click Select in the row for the building or property for which you want to forecast incomes and expenses.

The Forecast Capital Costs tab appears.

- Click the Forecast Income and Expenses tab.

The Forecast Income and Expenses tab shows the recurring cost records generated the last time this type of forecast was run.

- Click the Forecast Income and Expenses button at the top right of the screen.

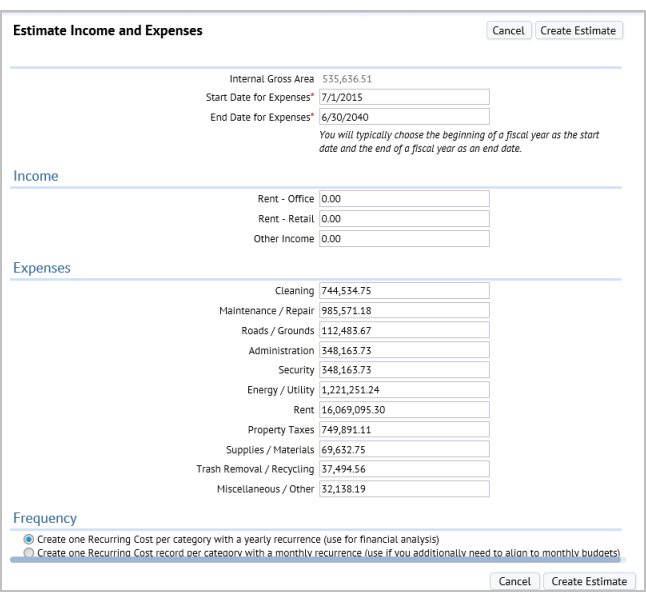

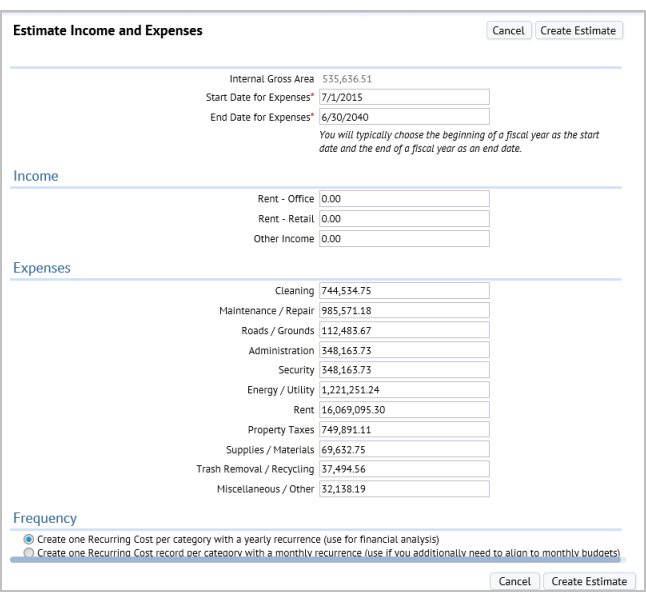

The Estimate Income and Expenses form appears.

The form is populated with default values as follows:

Internal Gross Area. If this is a building, this value shows the Internal Gross Area (bl.area_gross_int).

Start Date for Expenses / End Date for Expenses. You must enter the dates to begin and end creating expenses. Typically, these dates are the first and last dates of the fiscal year.

Income and Expense cost categories. Used to accept monthly or yearly estimate for this category of expense. You select the frequency as yearly or monthly using the Frequency section from the bottom of the form.

Defaults used for each cost categories. If there is an existing record for this cost category and asset, the application uses that record's value as a default. See How the application determines default values for cost categories

Frequency: Select one of the following:

- To align to monthly budgets, select to create one monthly recurring cost record per cost category.

- For Financial Analysis, keep the selection to one recurring cost record per financial analysis.

- Click Create Estimate

When you click Create Estimate, for each cost category, the application:

Deletes any existing recurring cost (cost_tran_recur) record for that category. More specifically, delete all recurring costs assigned to the specified building or property with a description (cost_tran_recur.description) of "OpEx Estimate - AUTO-FORECAST%," and the given cost category.

For any category that has a non-zero value, the application

- checks if there is already a record for that building or property and cost category. (This check ensures that these automatic estimates do not conflict with any existing estimates made manually in the Cost Wizard.)

- if not, creates a new recurring cost record for that category with the values below.

All forecast items are in the organizational budget currency, meaning that the "payment" amount and the "organizational budget" amount are the same.

The application uses 0.0 for VAT tax for the default forecast amounts. If you want to enter in a VAT tax for a particular Recurring Cost record, you can edit the record using the recurring cost form in the Cost Wizard and set the VAT tax directly.)

How the application determines default values for cost categories

For each cost category, if there is an existing record for this cost category and asset, the application uses that record's value as a default. For example, if building HQ has a recurring cost record for "CostCategory_Maintenance," the application uses the value of the latest recurring cost record for that asset and cost category as the default. The latest is the cost record with the maximum Autonumbered ID.

If the asset is a building, and if there is no existing record for this asset and cost category, the application creates an estimate as the default. See the Cost Categories section below for a description of the defaults used. The defaults are created as an array in JavaScript. Add-in managers can edit this array to change the defaults. The defaults are in USD per sqft.

Cost Categories

The following describes the cost categories the application uses for the forecast, and any default values used.

| Rent - Office |

CostCategory_RentIncomeOffice |

Other Rent |

<None. Use 0.0 as the default.>

|

| Rent - Retail |

CostCategory_RentIncomeRetail |

Retail Rent |

<None. Use 0.0 as the default.>

|

| Other Income |

CostCategory_IncomeOther |

Miscellaneous Income |

<None. Use 0.0 as the default.> |

| Custodial |

CostCategory_Custodial |

Cleaning |

$1.39

|

| Maintenance / Repair |

CostCategory_Maintenance |

Maintenance / Repair |

$1.84

|

| Roads / Grounds |

CostCategory_MaintenanceGrounds |

Roads / Grounds |

$ 0.21 |

| Administration |

CostCategory_Administration |

Administrative |

$0.65 |

| Security |

CostCategory_Security |

Security |

$0.65

|

| Energy / Utility |

CostCategory_Utility |

Utility |

$2.28

|

| Rental Expense |

CostCategory_RentExpense |

Directly Expense Leasing |

$30.00 |

| Property Taxes |

CostCategory_Tax |

Fixed |

$1.40 |

| Supplies / Materials |

CostCategory_AdminSupplies |

Supplies / Materials |

$0.13 |

| Trash / Recycling |

CostCategory_Trash |

Trash Removal / Recycling |

$0.07

|

| Miscellaneous / Other |

CostCategory_Misc |

Miscellaneous / Other |

$0.06 |

| Copyright © 1984-2016, ARCHIBUS, Inc. All rights reserved.

|