The Strategic Financial Analysis application does not assign costs directly to projects or equipment. This is because capital projects and equipment typically only generate mission value or income by being part of a larger facility. Particularly for NPV and IRR, looking at the return on the whole facility is typically the right level of granularity, so that the income for the facility can be gauged against the total expense in each timeframe over the facility lifecycle. For many metrics, the application assigns the project or equipment cost to the building or property, and sums the total project and equipment cost for that building or property. For this reason, if you are going to include capital projects or capital equipment in the analysis, you will use the Forecast Capital Costs action. When you run the Forecast Capital Costs action, the application includes costs for the asset you select and creates a finanal_params record for the project or equipment. See Forecast Capital Costs.

To include project and equipment costs in the unified cost model:

Capital Costs for Projects and Equipment are recorded as Scheduled Costs associated with the building within which the project or equipment reside. These costs are distinguished from building costs by the Cost Category. There are no scheduled costs for projects or equipment.

The metrics that apply to projects and equipment are these:

Even if the analyst does not include a project or equipment item in the analysis explicitly (by creating its own finanal_params record), any historic project costs are still rolled up with the building or property.

The Aggregate Operating Costs and the Forecast Capital Costs actions break out the capital project and capital equipment costs to separate cost categories. As such, you can opt to include the values for project and equipment costs in the following metrics for properties and buildings.

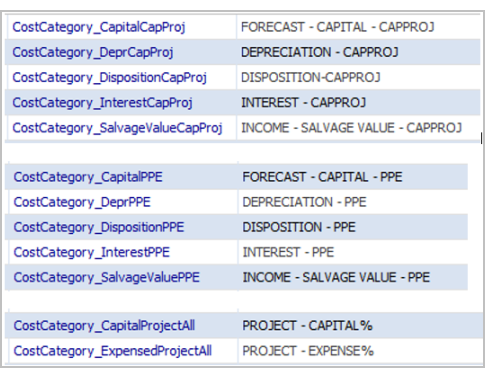

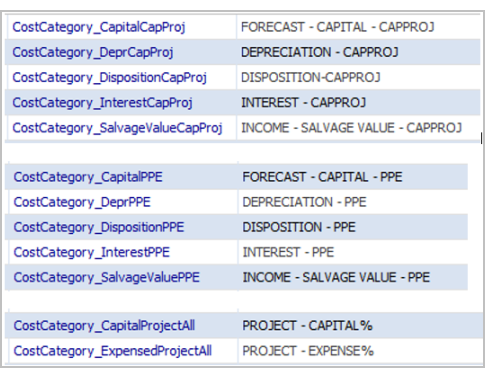

The application parameters controlling the cost categories for projects and equipment are below.

| To this metric | Add these cost categories |

|---|---|

| fin_anlys_RemainingMortgage_an |

CostCategory_PrincipalCapProj CostCategory_PrincipalPPE CostCategory_InterestCapProj CostCategory_InterestPPE |

| in_anlys_Interest_an_fy |

CostCategory_InterestCapProj CostCategory_InterestPPE |

| fin_anlys_Principal_an_fy |

CostCategory_PrincipalCapProj CostCategory_PrincipalPPE |

| fin_anlys_CostOfCapital_an_fy |

CostCategory_CapitalCapProj CostCategory_CapitalPPE |

| fin_anlys_Depreciation_an_fy |

CostCategory_DeprCapProj CostCategory_DeprPPE |

| cap_AnnualWorth_an_fy |

Add categories to UpdateAnnualWorth |

| leas_Costs-RemainingCommitment_an |

Add categories to CostCategory_RentAll |

Some metrics sum the Scheduled Costs assigned to properties or buildings from specific cost categories (e.g. DEPRECIATION - CAPPROJ, DEPRECIATION - PPE) that record project or equipment costs. If the cost has no building, it is summed to the property; otherwise, it is summed to the building. That is, these values are totals for the project or building. (These values are 0.0 for any project or equipment record in the Financial Analysis Summary finanal_sum table.)

Some project metrics are summed to buildings or properties from the costs in the projects table. These are summed to the property if the project has no building, otherwise, they are summed to the building.

Some project metrics are calculated from the metric trend values:

Note: The application also use the Financial Analysis Parameters values for projects and equipment in calculating the Capital and Expense Matrix values, which presents other totals on these outlays.

You only need to develop capital equipment or equipment that you may want to depreciate.

You can alternatively define a capital project that holds a group of equipment items (for example, 300 PC's) that you have purchased as a group, and will depreciate as a group.

If you do not have ARCHIBUS Asset Management:

If you have ARCHIBUS Asset Management

For Forecasting Capital Costs for Equipment

Cost analysts have several options of recording equipment, depending on their judgment as to which most accurately represents the value and the practicality of creating separate cost records.

|

Method |

Used For |

|---|---|

|

Tracking Equipment Market and Book Value with each Equipment record Note: The Market Value maps to the Current Value for the equipment in the Equipment Depreciation table (eq_dep.value_current.) |

equipment above a certain cost threshold that changes custody within the organization |

|

Tracking Equipment Market and Book Value with each Equipment record, and additionally using the "Estimate Charges for Capital Expenses" to record finance charges. This estimate is entered using the Forecast Income and Expenses action. |

expensive strategic assets, such as MRI equipment or manufacturing equipment, for which the organization makes distinct financing choices |

|

Tracking Equipment Market and Book Value as part of a Capital Project and not recording Equipment Market and Book Value with individual equipment records. |

equipment, such as a bulk purchase of computers for classrooms, that is aggregated for purchase or for depreciation (i.e. to bring the bulk purchase above the lower threshold value used by the organization for equipment costs that are depreciated). |

If you track Equipment value as part of a Capital Project:

| Copyright © 1984-2016, ARCHIBUS, Inc. All rights reserved. |