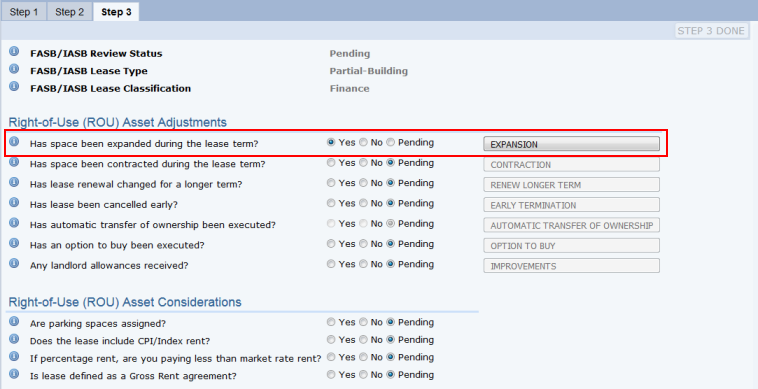

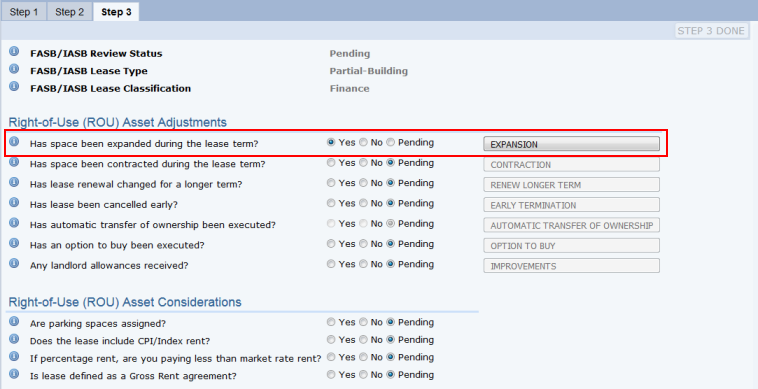

After you complete the Step 2 tab and the Wizard determines that you have a finance lease, the Wizard presents the Step 3 tab so that you can review a lease's right-of-use ease options and enter any adjustments to them. By entering changes to right-of use options, you might be able to reduce the ratio of initial liability. You can use the Step 3 tab to double check your list of options and make sure you considered everything that contributes to a lease classification. If necessary, you can create new options directly from the Step 3 tab.

Right-of-use lease options represent the lessee's right to use an asset over the terms of the lease. These can include:

Typically, right-of-use options are defined as part of the lease and you enter them into the system when initially entering the lease. However, when the options come due, you may need to edit the details, such as to set an option's Reasonably Certain to Yes or to enter an execution date. You can use the Step 3 tab to do so.

Depending on if the option has a one-time or a recurring cost, you will enter the option cost in the Options record or as a Recurring Cost. For information, see:

To examine your existing options or create new options, follow this procedure:

Note: If the Lease Type is Equipment, the Wizard presents only the questions and buttons for terminating a lease early and extending a lease; the other questions and buttons are omitted because they pertain to leased space but not to leased equipment.

Note: For the Automatic Transfer of Ownership option, the Wizard will automatically set this to Yes if an option already exists and is reasonably certain to be exercised. In this case, you cannot edit the value.

| Field | Description |

|---|---|

| Option Code | Enter a code to uniquely identify this option. |

| Description | Describe the option |

| Option Type |

The Wizard automatically completes this based on the right-of-use adjustment that you selected. |

| Is Reasonably Certain? |

A value of Yes causes the Lease Classification Wizard to include this option in its calculation of the Ratio of Initial Liability Over Fair Market Value of the Asset value. If this value is set to No, the Wizard ignores this value in its calculation of Ratio of Initial Liability Over Fair Market Value of the Asset. |

| Date Renewal Notice Signed | Enter the date the option was signed. |

| Exercised By | The user who exercised the option. |

| Date Exercised | Enter the date that the option will be exercised. |

| Cost Estimated |

Enter the estimated cost of exercising this option over the remainder of the lease. Note that if the cost is a savings, you need to enter it as a negative amount in the form. For example, if you are reducing your space and will pay less rent, you would enter the savings as a negative amount so that the Wizard can deduct the amount from Initial Direct Costs. Complete this field for only one-time costs. Otherwise, store the cost information in the Costs table. For information, see Concept: Lease Costs and Option Costs |

| Area Involved | Enter the area involved in the option. For example, if you are increasing the size of the leased area, enter the amount of the expansion. |

| Comments | Enter notes or a description of the option. |

Note: In its calculations, the Wizard considers all lease options whose Is Reasonably Certain? value is Yes. That is, it considers new lease options that you enter with the Lease Classification Wizard, as well as existing lease options that you might have entered for this lease using the Lease Portfolio Console.

Note: As you work through the Wizard's tabs, you may enter values that change the FASB/IASB Review Status. When this occurs, the Wizard creates a record in the Lease Classification Audit table so that you have a historical record of your changes.

Once you develop or edit the right-of-use options, complete the Step 3 form's remaining fields, which document additional information about your lease. The responses to these questions do not impact lease liability reassessment, but are handy for your reference when reviewing the lease.

| Field | Description |

|---|---|

|

Are parking spaces assigned?

|

Set to Yes if parking spaces are assigned to individual tenants of the building. If you have assigned parking spaces, you must include parking fees in the capitalized amount. |

| Does the lease include CPI/Index rent? |

If your lease has variable lease payments that depend on an index or a rate (such as the Consumer Price Index or a market interest rate), set this option to Yes. FASB ASC 842 stipulates that base rent’s CPI should only be included if a lease is re-categorized. |

| If percentage rent, are you paying less than market value? |

If you are paying a base that is below market price plus percentage rent, set this option to Yes. You will need to capitalize an estimate of the percentage rent. If you are paying market price rent along with a percentage of sales as an escalation, you do not need to capitalize the percentage rent. |

| Is lease defined as a gross rent agreement? |

If you pay one lump-sum fee for the lease, set this to Yes. FASB guidelines want to know if the rent is lump sum because it can be broken down by Real Estate Taxes, Operating Expenses, Utilities, and Other Service Rent. To represent this in the ARCHIBUS system, instead of creating one recurring cost record for GROSS RENT, create recurring cost records broken down by cost category (Real Estate Taxes, Operating Expenses, Utilities, and Other Service Rent). |

You can now route the classification for approval.

| Copyright © 1984-2019, ARCHIBUS, Inc. All rights reserved. |