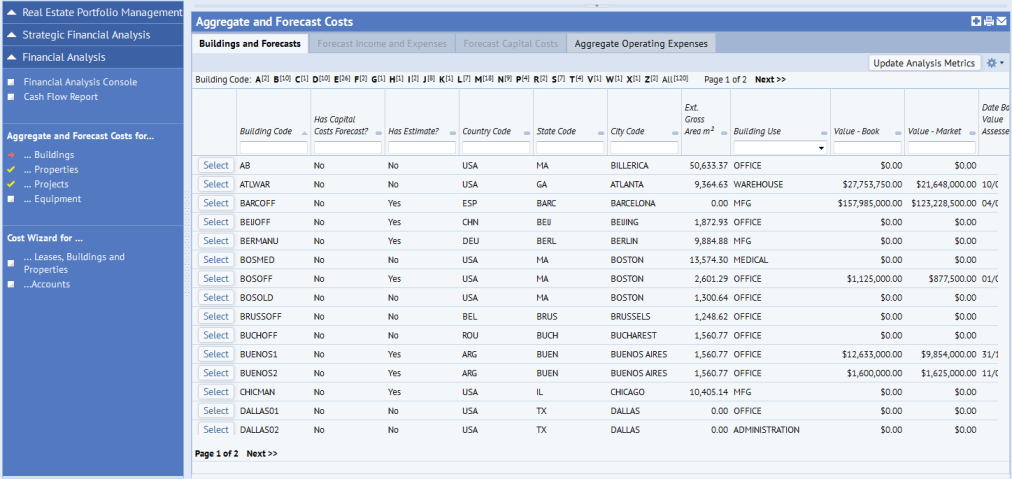

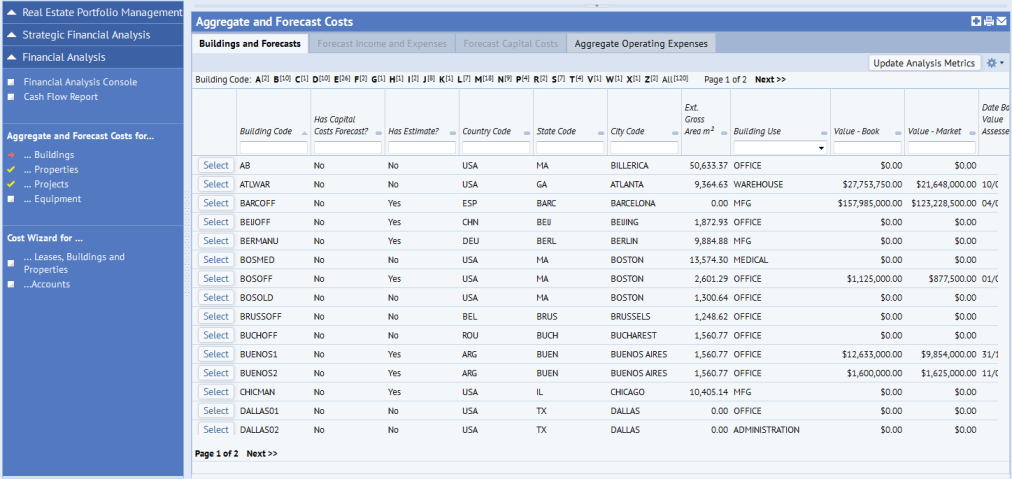

From the Real Estate Portfolio Management / Strategic Financial Analysis / Aggregate and Forecast Costs for ... views, you can aggregate and forecast costs, so that your organization has a unified structure that analyzes all expenses, as well as the ability to forecast capital costs and estimate income and expenses.

The console includes the following actions:

The following table shows the available actions, the view from which you run the action, and when you typically run it. The last column provides a link to the Help topic.

| Action | Invoked | From | When |

See |

|---|---|---|---|---|

| Aggregate Operating Expenses | Manually as a long-running rule |

Aggregate and Forecast Costs views - Aggregate Operating Costs tab |

|

Aggregate Operating Expenses

|

| Aggregate Operating Expenses | Also as a scheduled rule on last month's costs | Optionally, automatically, per month to integrate work request and service desk request costs. | ||

| Forecast Capital Costs | Manually as a message rule | Aggregate and Forecast Costs views - Forecast Capital Costs tab |

|

Forecast Capital Costs |

| Forecast Income and Expenses | Manually as a message rule |

Aggregate and Forecast Costs views for building and properties only - Forecast Capital Costs tab |

When you add a building or property and want to budget lifecycle expenses |

|

| Update Analysis Metrics | Manually as a long-running rule | Aggregate and Forecast Costs views - the Asset type Forecasts tab | When you wish to update the results on the Financial Analysis Console with the most recent costs and inventory data in the system. In essence, this action publishes a summary of data to the "data cube" that underlies the console. Similar to the way you may close accounts for the month or for the year, you may wish to invoke this action when you have verified that the imports and estimates are consistent. |

The Strategic Financial Analysis application uses cost categories when it aggregates operating expenses, when it creates cost records for forecasts, and when it sums costs from specific cost categories when calculating analysis metrics. See Define Application Parameters for Strategic Financial Analysis for a description of the cost categories that the application uses by default.

The Aggregate Operating Expenses action does not replace any manually entered costs, nor does it create any costs for the building / property, cost category and month where there is already a manually entered costs (based on cost status.) Manually entered costs have a cost status that is different than "AUTO-SUMMARY".

If you create cost categories for budget expenses that you enter manually, or for actual expenses that you enter manually, be sure to use cost categories that are distinct from those used by:

For instance, by default the Forecast Income and Expense Actions uses "MAINT" (i.e. the AbRPLMStrategicFinancialAnalysis-CostCategory_Maintenance application parameter value) as the Cost Category for any budgeted maintenance records. If you add your own records manually, use a different category, such as "MAINT-OUTSOURCED". In this way, your manually estimated costs will never "double up" with the automatically generated values. This approach also keeps Cost Administration processes from duplicating data. For instance, if you have a Recurring Cost for maintenance, and generate Scheduled Costs for it, the Cost Administration actions make sure there are not two records in effect for any time period by starting any Recurring Costs at the Changeover Date.

You can still use the roll up actions, such as Update Analysis Metrics, to roll up data from all cost categories into one analysis. For instance, Maintenance Costs (fy) metric – ops_Costs-Maintenance_an_fy – uses a wildcard to sum up all costs LIKE "MAINT%" (that is, the AbRPLMStrategicFinancialAnalysis-CostCategory_MaintenanceAll value). In this way, the metric can roll up both the automatically generated and manually generated values into one sum.

The following describes when you might want to have both manual and automatically generated costs:

SFA application parameters map analysis metrics to cost categories. Working from the Smart Client, add-in managers can personalize the cost category the application uses. See Define Strategic Financial Analysis Application Parameters.

The cost analysis calculations also include any of the Recurring Costs, Actual Costs, or Scheduled Costs that the cost administrator has entered manually using the features such as the Cost Wizard. These might include other kinds of costs like those in the following table.

By entering these kinds of costs using the Cost Wizard, they will appear in the Cash Flow report and in analyses, such as the Financial Analysis Console's metrics.

|

Category of Cost |

Description |

|---|---|

| Predicted Energy and Utility Costs | If a site wishes to include future months' expected energy and utility costs in the cost model, the cost administrator enters them in as a Recurring Cost record using the standard ARCHIBUS Cost Administration application features. These features schedule the Recurring Costs into future Scheduled Costs, which the cost analysis summaries include in the analysis. |

| Property Costs |

If your site has costs that are on the property level (for example, snow removal), you should use the usual features to enter these costs and prorate them to Scheduled Cost records at the building level, using the standard ARCHIBUS Cost Administration actions. The cost analysis will then include these costs as part of rolling up the operating expenses. |

| Rent | Lease Administrators enter recurring costs for Rent payments and escalations. The Cost Administration features schedule these out to Scheduled Cost records, which are included in the cost analysis. |

| Income | Other budget categories work similarly. For instance, a cost administrator can enter a recurring cost for expected rental income. |

Some costs tracked within ARCHIBUS, such as per-move costs, space costs, and Room Reservations costs, are internal budget costs. They are not inter-company charges. These are internal estimates used for internal chargeback. As such, the Aggregate Operating Expenses action does not aggregate them from their applications, and they are not added to the cost analysis model. Cost analysts might use the cost analysis features to determine what that internal charge should be. For instance, the Total Cost of Ownership per square foot or square meter may be the basis of the Space Chargeback cost for departments.

| Copyright © 1984-2016, ARCHIBUS, Inc. All rights reserved. |